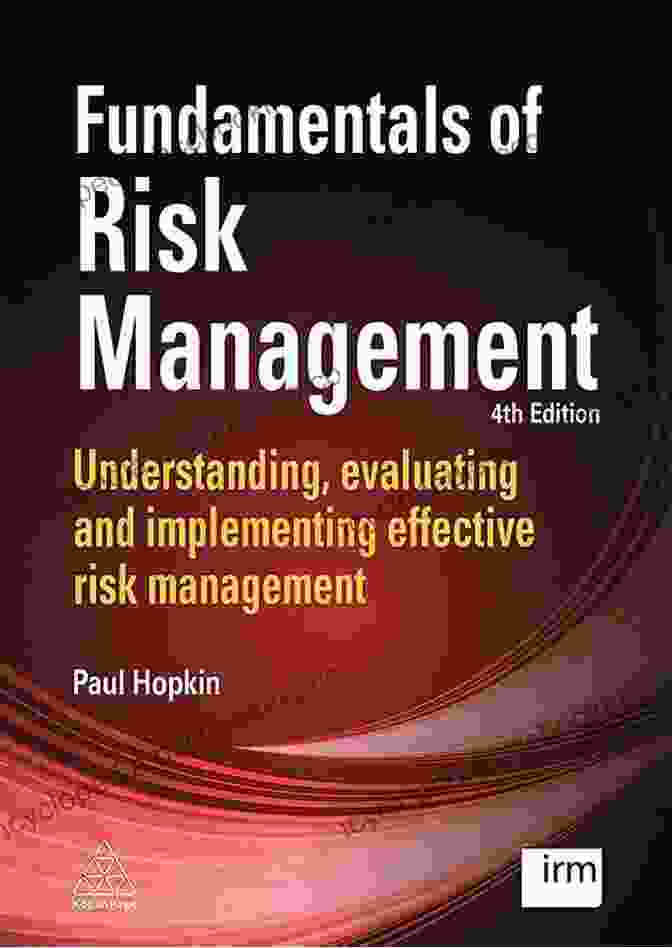

Unlocking the Power of Risk Management: Dive into the Fundamentals of Enterprise Risk Management

In today's rapidly evolving business landscape, the ability to manage risk effectively is crucial for organizations to thrive and maintain a competitive edge. The concept of enterprise risk management (ERM) has emerged as a comprehensive framework for addressing the diverse risks organizations face, empowering them to make informed decisions, enhance resilience, and navigate uncertainties proactively.

What is Enterprise Risk Management?

ERM is a holistic approach that encompasses all aspects of risk management within an organization. It provides a structured and systematic process for identifying, assessing, mitigating, and monitoring risks to achieve strategic objectives and create value. ERM involves assessing risks across the entire enterprise, considering internal and external factors, from operational hazards to financial uncertainties and reputational threats.

4.2 out of 5

| Language | : | English |

| File size | : | 4081 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 322 pages |

Benefits of Implementing Enterprise Risk Management

Implementing ERM brings numerous benefits to organizations, including:

1. Improved Decision-Making:

ERM provides a comprehensive view of risks, enabling organizations to allocate resources effectively and make informed decisions based on a deeper understanding of potential impacts.

2. Enhanced Resilience:

By proactively identifying and mitigating risks, organizations can build resilience, reduce potential disruptions, and protect their operations and assets.

3. Value Creation:

ERM empowers organizations to address risks that could hinder growth and profitability. By mitigating these risks, they can create value for stakeholders by maximizing opportunities and minimizing losses.

4. Compliance and Regulation:

ERM helps organizations comply with regulatory requirements and industry best practices related to risk management, reducing legal liabilities and enhancing reputational standing.

5. Competitive Advantage:

Organizations that effectively manage risk gain a competitive advantage by anticipating and responding to challenges before their rivals, enabling them to adapt to changing market conditions and seize opportunities.

Key Components of Enterprise Risk Management

The ERM framework consists of several key components:

1. Risk Identification:

The process of identifying and classifying potential risks that could impact the organization's objectives.

2. Risk Assessment:

Evaluating the likelihood and potential impact of identified risks to prioritize them based on severity and urgency.

3. Risk Mitigation:

Developing and implementing strategies to minimize or eliminate the risks identified as significant.

4. Risk Monitoring:

Continuously monitoring risks and their potential impacts to ensure timely responses to changing circumstances.

5. Risk Reporting:

Communicating risk assessments, mitigation strategies, and monitoring results to key stakeholders, including management, boards, and regulatory bodies.

Fundamentals of Enterprise Risk Management

The book "Fundamentals of Enterprise Risk Management" provides a comprehensive guide to understanding and implementing ERM in organizations. It covers various aspects of risk management, including:

1. Risk Management Principles:

Explores the fundamental principles and best practices of ERM, providing a solid foundation for building a robust risk management framework.

2. Risk Assessment Techniques:

Outlines different methods for identifying, assessing, and quantifying risks, enabling organizations to prioritize and address the most critical threats.

3. Risk Mitigation Strategies:

Presents practical strategies for mitigating risks, including risk avoidance, risk transfer, risk reduction, and risk acceptance, empowering organizations to tailor risk management plans to their specific needs.

4. Risk Monitoring and Control:

Provides guidelines for establishing effective risk monitoring systems and implementing controls to proactively manage risks and respond to emerging threats.

5. Risk Reporting and Communication:

Covers best practices for communicating risk information to key stakeholders, including decision-makers, regulatory bodies, and external audiences.

Target Audience for the Book

"Fundamentals of Enterprise Risk Management" is an invaluable resource for a wide range of professionals and organizations, including:

1. Risk Managers:

Provides a comprehensive understanding of ERM principles, techniques, and strategies, empowering risk managers to effectively manage risk and protect organizational assets.

2. Business Leaders:

Offers insights into the importance of ERM for strategic decision-making and value creation, enabling business leaders to incorporate risk considerations into their planning processes.

3. Auditors and Compliance Officers:

Provides a practical guide to ERM implementation and compliance with regulatory requirements, assisting auditors and compliance officers in ensuring organizational adherence to best practices.

4. Students and Academicians:

Serves as a comprehensive textbook for students pursuing risk management and related disciplines, offering a comprehensive overview of ERM concepts and applications.

In the face of increasing complexity and uncertainty, the implementation of enterprise risk management has become essential for organizations to achieve their strategic objectives and maintain competitiveness. "Fundamentals of Enterprise Risk Management" provides a comprehensive guide to understanding and implementing ERM, empowering organizations to proactively identify, assess, mitigate, and monitor risks, unlocking the full potential of risk management for value creation and sustainable growth.

4.2 out of 5

| Language | : | English |

| File size | : | 4081 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 322 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Alan M Dershowitz

Alan M Dershowitz Al Barrera

Al Barrera 365 Conseils

365 Conseils 2004th Edition Kindle Edition

2004th Edition Kindle Edition Aaron Spencer Fogleman

Aaron Spencer Fogleman Alex Morgan

Alex Morgan Alastair Mcintosh

Alastair Mcintosh Abigail Tucker

Abigail Tucker Aaron Wilson

Aaron Wilson Aaron Mahnke

Aaron Mahnke A J Mackinnon

A J Mackinnon Alex Aster

Alex Aster A E Hodge

A E Hodge Ae Marling

Ae Marling Akaisha Kaderli

Akaisha Kaderli Alex Campbell

Alex Campbell Ainsley Arment

Ainsley Arment Achy Obejas

Achy Obejas Alan C Martin

Alan C Martin Alan Axelrod

Alan Axelrod

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Samuel Taylor ColeridgeUnveiling the Dark and Twisted World of "The Saint of Wolves and Butchers"

Samuel Taylor ColeridgeUnveiling the Dark and Twisted World of "The Saint of Wolves and Butchers"

Kevin TurnerUnleash the Magic: Embark on an Epic Journey with 'The Adventures of Little...

Kevin TurnerUnleash the Magic: Embark on an Epic Journey with 'The Adventures of Little... Roy BellFollow ·15.5k

Roy BellFollow ·15.5k Robert BrowningFollow ·2k

Robert BrowningFollow ·2k Brandon CoxFollow ·11.2k

Brandon CoxFollow ·11.2k Ernest ClineFollow ·7.1k

Ernest ClineFollow ·7.1k William PowellFollow ·6.5k

William PowellFollow ·6.5k Oscar WildeFollow ·8.8k

Oscar WildeFollow ·8.8k Felix CarterFollow ·3.9k

Felix CarterFollow ·3.9k Jack PowellFollow ·10.5k

Jack PowellFollow ·10.5k

Francis Turner

Francis TurnerArt and Politics in the Shadow of Music

Music has...

Jaylen Mitchell

Jaylen MitchellHow Algorithms Are Rewriting The Rules Of Work

The workplace is...

Chandler Ward

Chandler WardRio de Janeiro & Minas Gerais Footprint Handbooks:...

Embark on an extraordinary adventure through...

David Mitchell

David MitchellThe Story of Depression: Understanding and Treating a...

Delving into the Shadows of...

Al Foster

Al FosterStatistics Done Wrong: The Woefully Complete Guide

Tired of being...

DeShawn Powell

DeShawn PowellJulia Child's Second Act: A Tale of Triumph,...

Julia Child is an...

4.2 out of 5

| Language | : | English |

| File size | : | 4081 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 322 pages |