How to File Your Tax Return Accurately: A Comprehensive Guide to Empowering Taxpayers

: Embracing Tax Filing with Confidence

The annual tax filing season can be a daunting task for individuals and businesses alike. Navigating the complexities of tax laws and ensuring accuracy can be a challenge without the proper guidance. To empower taxpayers and alleviate the stress associated with tax preparation, this comprehensive guide provides a step-by-step approach to filing your tax return accurately.

Chapter 1: Gathering Essential Information

Before embarking on the tax filing process, it is crucial to compile the necessary documents and information. This includes your Social Security number, income statements, deduction records, and any other relevant paperwork. Organizing your documents in advance will streamline the filing process and minimize errors.

4.4 out of 5

| Language | : | English |

| File size | : | 448 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 97 pages |

| Lending | : | Enabled |

Chapter 2: Selecting the Appropriate Filing Method

Depending on your circumstances, you can choose from various filing methods, including:

- Electronic Filing: Utilizing tax filing software or online services for quick, convenient, and secure submissions.

- Paper Filing: Downloading and completing IRS tax forms and mailing them to the designated address.

- Professional Tax Preparer: Hiring a qualified tax preparer if you require expert assistance or have complex tax situations.

Chapter 3: Calculating Your Income

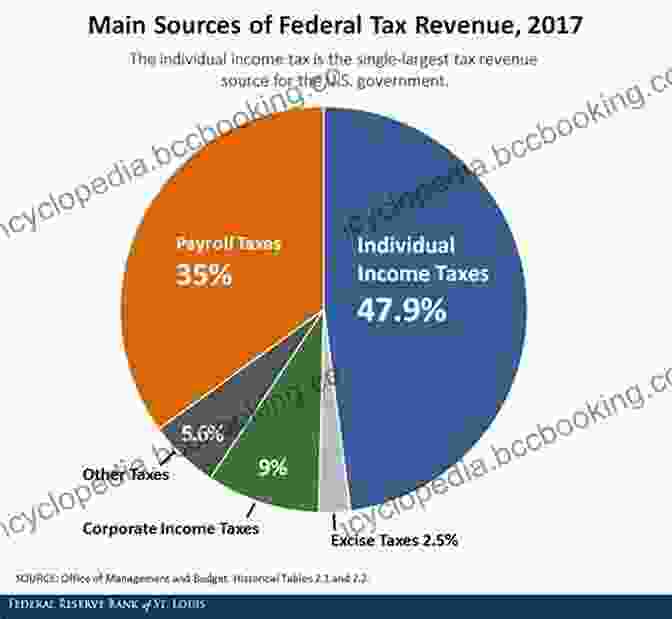

Accurately calculating your income is the foundation for a successful tax return. This involves identifying and totaling all sources of income, such as wages, salaries, investments, dividends, and self-employment earnings. The IRS provides detailed instructions on how to report various income types.

Chapter 4: Itemizing or Standard Deductions

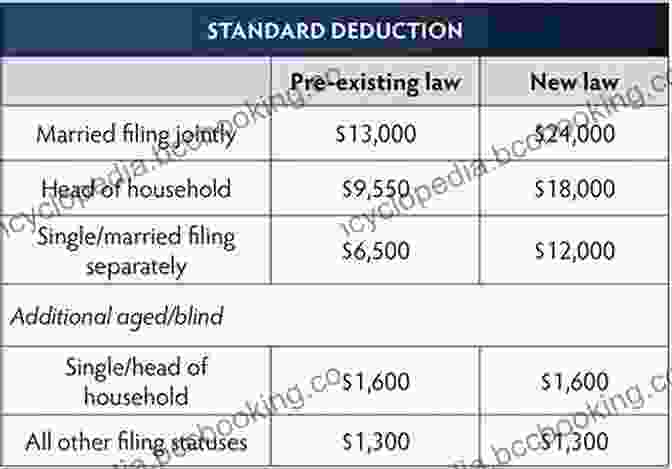

Determining whether to itemize or take the standard deduction is crucial to maximizing your tax savings. Itemizing involves listing all eligible expenses, while the standard deduction is a set amount based on your filing status. Comparing both options and selecting the one that yields the greater tax benefit is essential.

Chapter 5: Understanding Tax Credits and Deductions

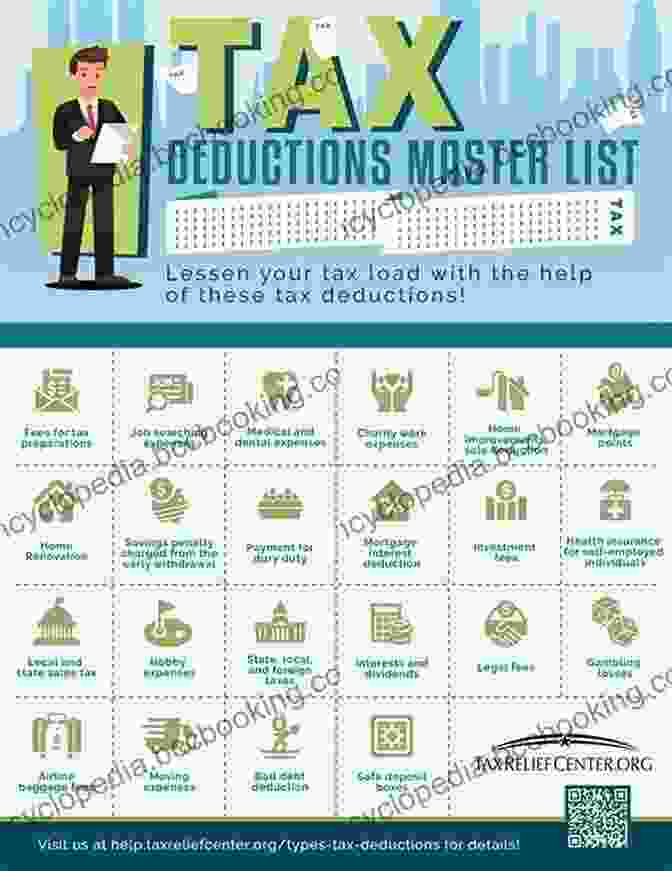

Tax credits directly reduce your tax liability, while deductions reduce your taxable income. Familiarizing yourself with eligible tax credits and deductions, such as the Earned Income Tax Credit, child tax credit, and mortgage interest deduction, can significantly impact your tax refund or tax liability.

Chapter 6: Reporting Capital Gains and Losses

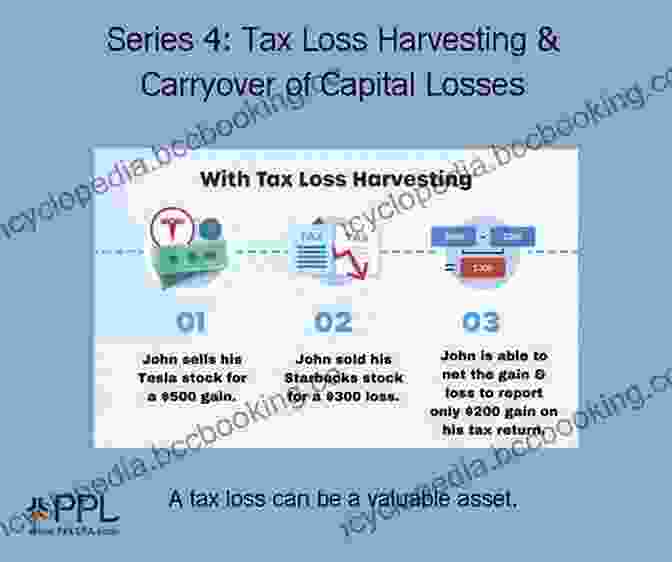

If you have sold stocks, bonds, or other investments during the tax year, you must report the capital gains or losses. The IRS classifies gains and losses as short-term or long-term, which affects how they are taxed. Accurate reporting of capital transactions is crucial to avoid overpaying taxes.

Chapter 7: Common Tax Mistakes to Avoid

Understanding common tax mistakes can prevent costly errors and potential penalties from the IRS. Some common pitfalls to avoid include:

- Incorrectly reporting income or expenses.

- Failing to claim eligible tax credits and deductions.

- Missing important filing deadlines.

- Not keeping proper documentation.

Chapter 8: Filing Your Tax Return

Once you have completed all the necessary calculations and gathered your supporting documents, it's time to file your tax return. Whether you choose electronic or paper filing, ensure that you review your return carefully before submitting it to the IRS.

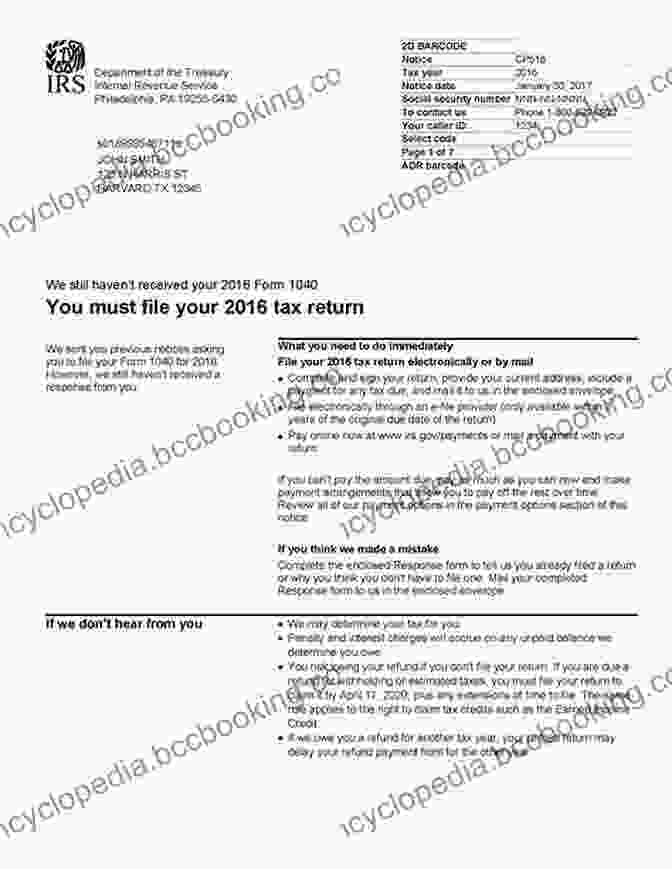

Chapter 9: Responses to IRS Notices and Audits

In some cases, you may receive a notice from the IRS requesting additional information or auditing your return. Understanding how to respond appropriately to these notices and conducting thorough record-keeping can help resolve any issues efficiently.

: Empowering Taxpayers with Accuracy

With the guidance provided in this comprehensive guide, individuals and businesses can confidently navigate the tax filing process, ensuring accuracy, reducing potential errors, and maximizing their tax savings. Remember, tax laws and regulations are constantly evolving. Staying updated with the latest information and seeking professional assistance when necessary can ensure that your tax returns are filed accurately and efficiently.

4.4 out of 5

| Language | : | English |

| File size | : | 448 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 97 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Alex Bonham

Alex Bonham Adam Cates

Adam Cates Alan C Greenberg

Alan C Greenberg Adrian Shaughnessy

Adrian Shaughnessy Adam Hochschild

Adam Hochschild Abigail Griebelbauer

Abigail Griebelbauer Aaron Mahnke

Aaron Mahnke Aisling Fowler

Aisling Fowler Adrienne Brodeur

Adrienne Brodeur Al Desetta M A

Al Desetta M A Alan Pesky

Alan Pesky Alan Gallop

Alan Gallop Abhijit V Banerjee

Abhijit V Banerjee Alan Bristow

Alan Bristow Abigail Drake

Abigail Drake Alan Rushton

Alan Rushton Albrecht Wacker

Albrecht Wacker Abby Denson

Abby Denson Aivee Black

Aivee Black Alan Sanders

Alan Sanders

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

William FaulknerEmbark on an Unforgettable Adventure Down Under with "Up Creek Down Under"

William FaulknerEmbark on an Unforgettable Adventure Down Under with "Up Creek Down Under"

Randy HayesUnlock an Unforgettable Adventure with Shonen Jump Graphic Novel: Unleashing...

Randy HayesUnlock an Unforgettable Adventure with Shonen Jump Graphic Novel: Unleashing... Desmond FosterFollow ·6.6k

Desmond FosterFollow ·6.6k José SaramagoFollow ·9.6k

José SaramagoFollow ·9.6k Felipe BlairFollow ·7.6k

Felipe BlairFollow ·7.6k Drew BellFollow ·2.9k

Drew BellFollow ·2.9k Derek BellFollow ·11.3k

Derek BellFollow ·11.3k Connor MitchellFollow ·3.7k

Connor MitchellFollow ·3.7k Roland HayesFollow ·6.8k

Roland HayesFollow ·6.8k Thomas HardyFollow ·15.9k

Thomas HardyFollow ·15.9k

Francis Turner

Francis TurnerArt and Politics in the Shadow of Music

Music has...

Jaylen Mitchell

Jaylen MitchellHow Algorithms Are Rewriting The Rules Of Work

The workplace is...

Chandler Ward

Chandler WardRio de Janeiro & Minas Gerais Footprint Handbooks:...

Embark on an extraordinary adventure through...

David Mitchell

David MitchellThe Story of Depression: Understanding and Treating a...

Delving into the Shadows of...

Al Foster

Al FosterStatistics Done Wrong: The Woefully Complete Guide

Tired of being...

DeShawn Powell

DeShawn PowellJulia Child's Second Act: A Tale of Triumph,...

Julia Child is an...

4.4 out of 5

| Language | : | English |

| File size | : | 448 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 97 pages |

| Lending | : | Enabled |