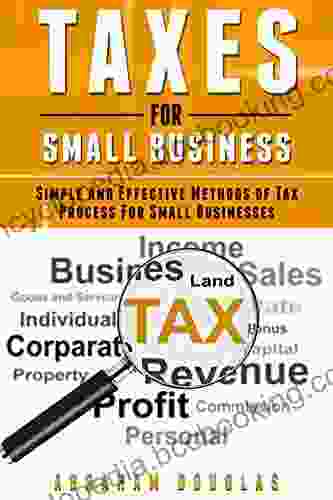

Unlocking Tax Savings: The Ultimate Guide for Small Businesses

Starting and running a small business is an exciting endeavor, but it also comes with its share of financial responsibilities, including taxes. Navigating the complex tax landscape can be daunting, but it's crucial for small business owners to understand their tax obligations to maximize profits and minimize their tax burden.

4.3 out of 5

| Language | : | English |

| File size | : | 1487 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 141 pages |

| Lending | : | Enabled |

This comprehensive guide will provide you with an in-depth understanding of taxes for small businesses. We'll cover everything from the different types of business taxes to strategies for tax planning and deductions that can save you money.

Understanding Business Taxes

There are several types of taxes that small businesses may need to pay, depending on their structure and location. These include:

- Income tax: This is the tax you pay on your business profits.

- Self-employment tax: This tax covers Social Security and Medicare contributions for self-employed individuals.

- Sales tax: This tax is levied on the sale of goods or services.

- Property tax: This tax is levied on the ownership of real estate.

- Payroll tax: This tax is withheld from employees' wages to cover Social Security, Medicare, and unemployment insurance.

Tax Planning for Small Businesses

Tax planning is essential for small businesses to minimize their tax liability and maximize their cash flow. Here are some key strategies to consider:

- Choosing the right business structure: The legal structure of your business can impact your tax obligations. Consider factors such as liability, tax rates, and administrative costs when making this decision.

- Keeping accurate records: Maintaining detailed financial records is crucial for tax filing and planning. Keep track of all income, expenses, and business transactions.

- Maximizing deductions: There are many deductions available to small businesses that can reduce their taxable income. These include expenses for advertising, equipment, and employee benefits.

- Taking advantage of tax credits: Tax credits provide direct reductions in your tax liability. Explore government incentives and tax breaks that may apply to your business.

Tax Deductions for Small Businesses

Small businesses can deduct many expenses from their taxable income, including:

- Business expenses: These include expenses directly related to the operation of your business, such as rent, utilities, and supplies.

- Employee expenses: These include salaries, wages, and benefits paid to employees.

- Interest expenses: These include interest paid on business loans and mortgages.

- Depreciation and amortization expenses: These include allowances for the wear and tear of business assets.

- Research and development expenses: These include expenses related to the development of new products or processes.

Tax Filing for Small Businesses

Small businesses must file taxes regularly with the Internal Revenue Service (IRS). The specific filing requirements depend on the type of business and its structure. Here are some key filing deadlines:

- Form 1040 (individual income tax return): April 15

- Form 1040-ES (estimated tax payments): April 15, June 15, September 15, and January 15

- Form 1120 (corporate income tax return): March 15

- Form 1065 (partnership income tax return): April 15

It's important to note that these deadlines may vary depending on the specific circumstances of your business. It's always advisable to consult with a tax professional or the IRS for the most up-to-date information.

Understanding taxes is essential for the success of any small business. By implementing effective tax planning strategies, maximizing deductions, and filing taxes correctly, you can minimize your tax burden and free up more cash flow for your business. Remember to consult with a tax professional for personalized advice and guidance.

This guide provides a comprehensive overview of taxes for small businesses. For more detailed information, refer to the resources below:

- Internal Revenue Service (IRS)

- Small Business Administration (SBA)

- Service Corps of Retired Executives (SCORE)

Unlock your business's potential by mastering taxes. Let this guide be your roadmap to financial success.

4.3 out of 5

| Language | : | English |

| File size | : | 1487 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 141 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Adeline Yen Mah

Adeline Yen Mah Alex Duncan

Alex Duncan Ak Turner

Ak Turner A Helwa

A Helwa Adam B Schiff

Adam B Schiff Aaron Glantz

Aaron Glantz Aaron Sanchez

Aaron Sanchez Adam Stevens

Adam Stevens A R Winters

A R Winters Alan Gillies

Alan Gillies A Roger Ekirch

A Roger Ekirch Alex M Hall

Alex M Hall Akilah S Richards

Akilah S Richards Adam J Levitin

Adam J Levitin Adiba Jaigirdar

Adiba Jaigirdar Akash Kapur

Akash Kapur Adam Graham

Adam Graham 2005th Edition Kindle Edition

2005th Edition Kindle Edition Alex Berenson

Alex Berenson Adam Mckeown

Adam Mckeown

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Duane KellyUnder the Same Roof with the Guy I Hate: A Romantic Comedy to Make You Laugh...

Duane KellyUnder the Same Roof with the Guy I Hate: A Romantic Comedy to Make You Laugh...

Herman MitchellEmpowering Educators with Essential Soft Skills: Unlocking Student Success

Herman MitchellEmpowering Educators with Essential Soft Skills: Unlocking Student Success Theo CoxFollow ·6.6k

Theo CoxFollow ·6.6k Nathaniel PowellFollow ·10.1k

Nathaniel PowellFollow ·10.1k Charles ReedFollow ·6.3k

Charles ReedFollow ·6.3k Ian MitchellFollow ·19.8k

Ian MitchellFollow ·19.8k Jermaine PowellFollow ·13.2k

Jermaine PowellFollow ·13.2k Tony CarterFollow ·6k

Tony CarterFollow ·6k David BaldacciFollow ·3.8k

David BaldacciFollow ·3.8k Duane KellyFollow ·18.9k

Duane KellyFollow ·18.9k

Francis Turner

Francis TurnerArt and Politics in the Shadow of Music

Music has...

Jaylen Mitchell

Jaylen MitchellHow Algorithms Are Rewriting The Rules Of Work

The workplace is...

Chandler Ward

Chandler WardRio de Janeiro & Minas Gerais Footprint Handbooks:...

Embark on an extraordinary adventure through...

David Mitchell

David MitchellThe Story of Depression: Understanding and Treating a...

Delving into the Shadows of...

Al Foster

Al FosterStatistics Done Wrong: The Woefully Complete Guide

Tired of being...

DeShawn Powell

DeShawn PowellJulia Child's Second Act: A Tale of Triumph,...

Julia Child is an...

4.3 out of 5

| Language | : | English |

| File size | : | 1487 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 141 pages |

| Lending | : | Enabled |